Banking and AI: Why Up to 15% Annual Revenue Growth Is on the Line

- sofiacharvatova

- Aug 15, 2025

- 4 min read

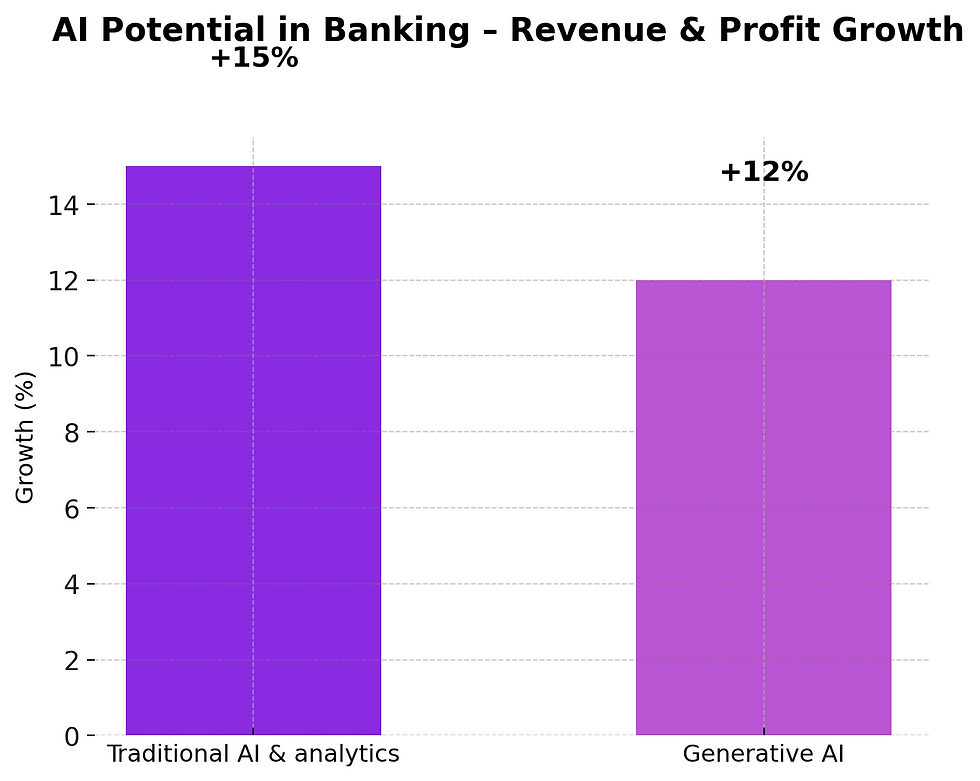

The banking industry is standing on the edge of a transformation bigger than mobile banking and bigger than digitization itself. Artificial intelligence is no longer a support function—it has become a growth engine. McKinsey’s research is clear: AI and analytics can add up to 15% in additional annual revenues for banks. Generative AI, still in its early adoption phase, adds another 9–15% profit potential.

The question is no longer if banks will adopt AI, but how fast and how effectively. Those who move now are creating compound advantages that late movers may never be able to catch.

From Digital Banking to AI Banking

For decades, banks have steadily digitized their services. Internet banking in the 1990s, mobile apps in the 2010s, and open banking initiatives in the 2020s. Each step improved convenience, lowered costs, and reshaped customer expectations.

AI, however, is not just another technology milestone. It changes the very operating model of a bank. While digitization focused on channels and interfaces, AI transforms the decision-making and execution that power every product, service, and process.

Where digitalization put banking online, AI makes banking intelligent.

The First Wave: Traditional AI and Analytics

McKinsey estimates that AI and advanced analytics can unlock up to 15% annual revenue growth. The gains come from three primary areas:

Marketing and Sales - Banks that personalize product offerings based on customer behavior and next-best-action models see stronger conversion rates and higher wallet share. AI enables precision that manual segmentation never could.

Risk Management - AI-driven underwriting and real-time fraud detection strengthen resilience and expand revenue. Faster, more accurate credit scoring allows banks to serve segments previously considered too risky—opening new markets without compromising safety.

Operations - Automating repetitive tasks across HR, IT, and customer service reduces inefficiencies. Employees can focus on value-creating work, while AI ensures consistency and speed.

Case Example: A European retail bank applied AI models to personalize credit card offers. Conversion rates increased by 30%, directly impacting annual revenues. This is not cost-cutting, it’s top-line growth.

The Second Wave: Generative AI and AI Agents

While traditional analytics unlock efficiency and incremental revenue, generative AI creates entirely new ways of working. McKinsey projects an additional 9–15% in operating profit through AI-powered transformation of workflows.

Customer Service: AI agents handle first-line inquiries with contextual precision, reducing call center volumes while improving customer satisfaction.

Compliance and Reporting: Generative AI drafts reports, monitors transactions, and helps banks stay aligned with increasingly complex regulations.

Product Development: AI agents analyze customer data, market trends, and competitor activity to accelerate innovation cycles.

Case Example: A North American bank deployed generative AI agents for compliance documentation. The result: 40% reduction in reporting time, freeing compliance officers to focus on higher-value oversight while cutting operating costs significantly.

This is why AI agents are not just tools - they are becoming digital colleagues, embedded in the bank’s daily workflows.

Early Adopters vs. Late Movers

The competitive divide is already visible:

Early adopters

Achieve double-digit productivity gains in frontline and back-office functions.

Create cultural momentum for innovation, attracting both talent and customers.

Scale pilots into enterprise-wide orchestration before others move beyond experimentation.

Late movers

Face fragmented pilots with no measurable ROI.

Struggle with regulatory compliance as they rush to catch up.

Lose market share to more innovative competitors that deliver AI-enabled customer experiences.

In short: every quarter of delay increases the competitive gap.

Regulation and Trust: The European Lens

For banks in Europe, regulation is not an obstacle, it is a mandate. The upcoming EU AI Act sets strict requirements for risk, transparency, and accountability. Banks that approach AI with “pilot-and-see” strategies risk non-compliance, reputational damage, and financial penalties.

The opportunity, however, is to turn regulation into an advantage. By adopting compliance-ready AI agent orchestration, banks can move faster than competitors who wait until regulations are finalized.

Trust has always been the currency of banking. AI must enhance, not erode, that foundation.

ELEMENT AI: From Potential to Performance

At Elevon.io, we created ELEMENT AI to solve the challenge of orchestration. Banks don’t just need AI, they need AI agents that work together across the enterprise.

Orchestrated AI Agents: Connecting marketing, risk, compliance, and operations into seamless workflows.

Compliance Built-In: Designed to align with regulatory frameworks from day one.

Scalable Integration: Modular deployment without vendor lock-in or system fragmentation.

ELEMENT AI ensures that AI is not another silo, but a connected layer of intelligence across the entire organization.

The Roadmap for Banks

Banks that want to capture the full value of AI can follow a three-step approach:

Audit and Prioritize: Identify the business processes with the highest potential revenue impact - marketing, compliance, product development.

Pilot with Purpose: Launch AI agents in controlled workflows with clear metrics. Avoid “AI for the sake of AI.”

Orchestrate and Scale: Move beyond isolated pilots by orchestrating AI agents across departments. Integration is where the real value—and the 15% revenue growth - materializes.

Measurement must go beyond cost savings. The real metric is revenue growth and profit impact.

Result

AI is no longer optional. With up to 15% revenue growth from AI and analytics and another 9–15% profit upside from generative AI, the winners will be those who act with urgency and discipline.

Banks that wait risk being locked out of the next growth wave. Banks that act now can set the benchmark for the industry.

The question is simple: will your institution lead this wave, or be forced to follow?

👉 Book a free consultation with Elevon.io today to explore how ELEMENT AI can accelerate your banking transformation.

AI in banking isn’t a side project, it’s a growth engine. With up to 15% additional revenues from AI and analytics, plus another 9–15% profit upside from generative AI, the winners will be those who act with urgency and discipline.